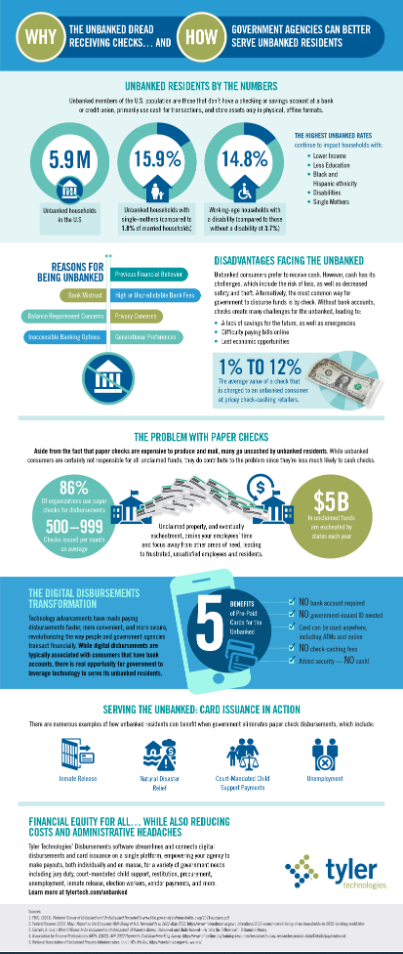

Paper Checks Create Numerous Challenges For Your Unbanked Residents

The Hassle-Free Way to Pay Residents Accurately and On Time

Tyler’s Disbursements software streamlines and connects digital disbursements and card issuance on a single platform, empowering your agency to make payouts, both individually and en masse, for a variety of government needs including jury duty, court-mandated child support, restitution, procurement, unemployment, inmate release, election workers, vendor payments, and more.

Unbanked members of the U.S. population are those that don’t have a checking or savings account at a bank or credit union, primarily use cash for transactions, and store assets only in physical, offline formats.

Learn how digital disbursements can help your agency create financial equity for all… while also reducing costs and administrative headaches.

Learn how digital disbursements can help your agency create financial equity for all… while also reducing costs and administrative headaches.

Looking for more information?

GOVERNMENT TECHNOLOGY PAPER AND WEBINAR

Improving Financial Equity: New disbursement options support unbanked and underbanked residents.

Nearly 6 million U.S. households don't have traditional checking or savings accounts. Yet many agencies continue to issue payments using paper checks or methods such as direct deposit that are difficult for unbanked residents to use. This paper and webinar explain how agencies can expand their options for issuing payments to constituents, providing equity for unbanked residents and better convenience and more payment choices for everyone.